Our analyst recommendations

Wait until after the rate decision and FOMC meeting minutes to determine a fundamental and technical bias.

What will the Federal Reserve deliver in its first interest rate cut?

Over the past couple of weeks there has been a clear divide between traders, analysts and hedge funds on whether the federal reserve is going to cut interest rates by 25bps or 50bps.

We’ve seen gold hitting all-time highs and equities pushing higher, yields have fallen along with the dollar. With the weaker unemployment data last week the markets switched to a 50bps rate cut.

This is what has been driving the markets bullish for gold and equities since last Thursday 12th September 2024. Could this be an overreaction and could we see just a 25bps reduction from the federal reserve.

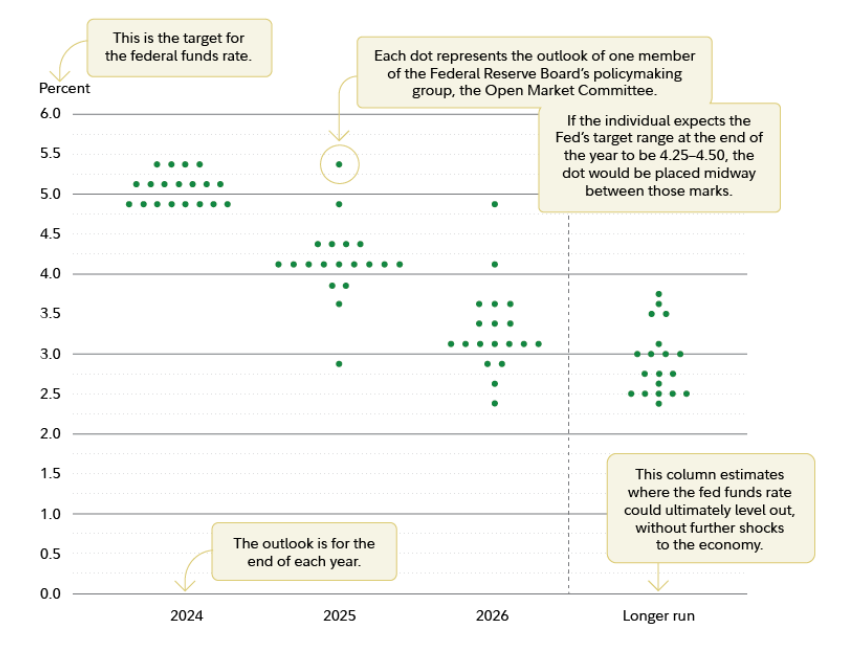

The current projected dot plot is displayed below. The markets are expecting a 100bps rate cut by December 2024, this would mean the Federal Reserve would have to either deliver a 25bps now and hold back till the next FOMC meeting and deliver a bigger rate cut to tie in with the markets expectations.

The Fed’s dot plot is a chart updated quarterly that records each Fed official’s projection for the central bank’s key short-term interest rate, the federal funds rate. The dots reflect what each U.S. central banker thinks will be the appropriate midpoint of the fed funds rate at the end of each calendar year.

With the elections just around the corner, our question is will the Federal Reserve play it safe tomorrow and deliver a 25bps or will the federal reserve deliver a hammer approach with a 50bps. This could show the markets that the federal reserve was late is delivering the first interest rate cut.

Dollar and yields have fallen over the past two weeks leading up to the rate decision – Wednesday 18th September 19:00 GMT. Traders see a 65% chance for a 50bps reduction and 35% reduction for 25bps cut. according to the CME FedWatch tool.