Bank of England Holds Interest Rates at 5%

Important Headlines

- BANK OF ENGLAND POLICYMAKERS VOTE 7-2 TO HOLD RATES AT 5.0%

- BOE’S BAILEY: WE NEED TO BE CAREFUL NOT TO CUT RATES TOO FAST OR BY TOO MUCH

- BOE KEEPS PHRASE: “MONETARY POLICY WILL NEED TO CONTINUE TO REMAIN RESTRICTIVE FOR SUFFICIENTLY LONG”

On Thursday 19th September 2024, the Bank of England has left rates unchanged at 5% with the vote cut at:

UK rate futures price of 66% chance of bank of England rate cut in November vs fully priced in before decision.

This comes after the Federal reserve reduced interest rates by 50bps yesterday and the Euro central bank made its second rate cut this year.

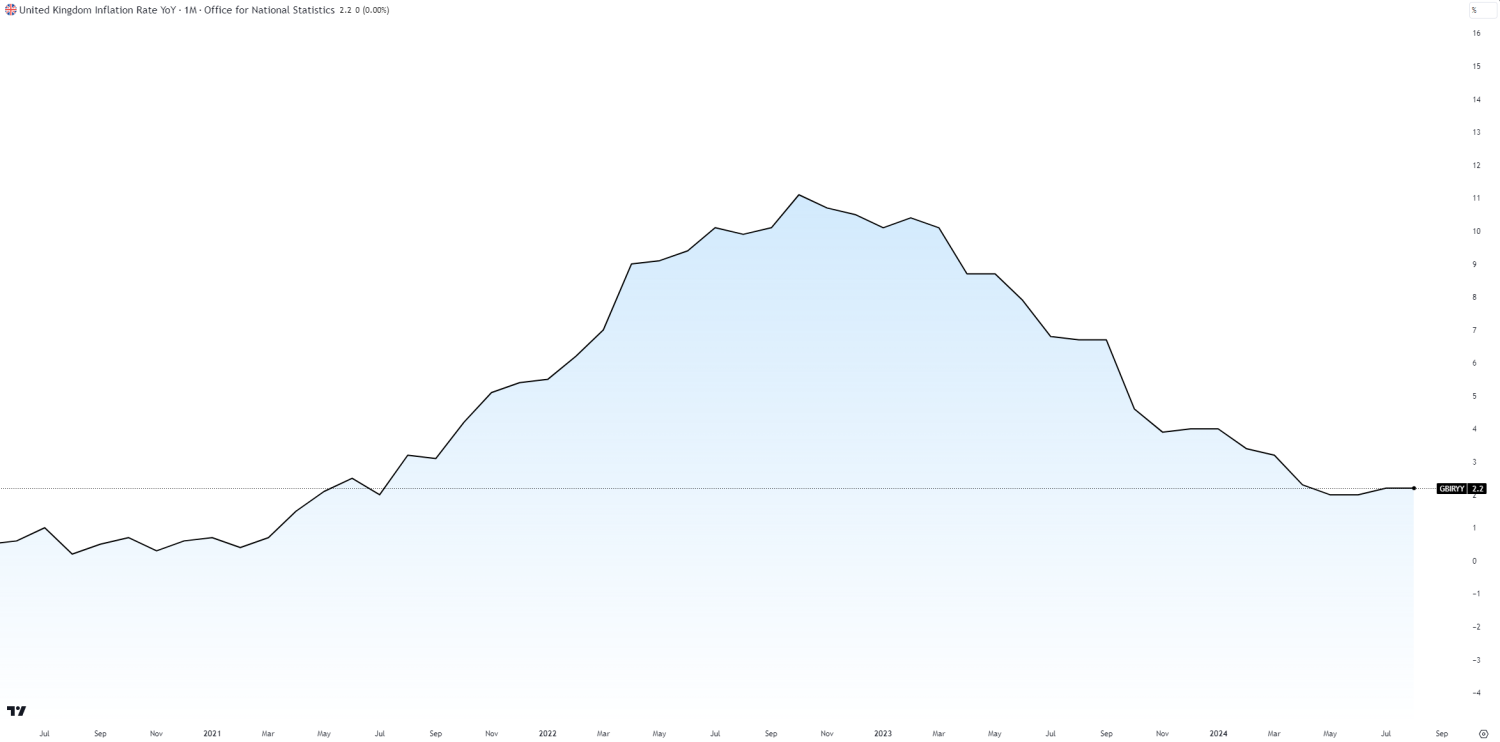

The Bank of England monetary policy committee predicated that inflation will edge higher to 2.5% in Q4 2024, while the economy will grow at 0.3%.

Governor Andrew Bailey

Cooling inflation pressure meant the BoE should be able to cut interest rates gradually over the months ahead.

“But it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much,”

The MPC voted 9-0 to maintain the pace of its quantitative tightening programme in the 12 months starting in October 2024.

QT represents the reversal of hundreds of billions of pounds of British government bond purchases from past attempts to stimulate the economy, by letting these gilts mature but also through active sales.

The 100 billion pound pace of QT over the coming 12 months will be the same as over the past year, in line with market expectations.

The BoE stuck to its view the QT process was proceeding smoothly, with only a “modest” impact on the stance of monetary policy overall.