ECB Lowers Interest Rate by 25bps

Important Headlines

- Lagarde and executive board member Schnabel stated that the economy’s recovery was ‘facing headwinds’ which ‘[could not be] ignored

- ECB officials largely acknowledged that downside risks to growth were starting to materialise

On Thursday 17th October 2024, the ECB (Euro Central Bank) trimmed interest rates by 25bps to 3.25%.

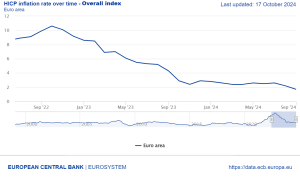

ECB Lowers Interest rate with its second cut in a row after September’s move. The already-high probability of this latest rate cut had jumped even higher on Thursday morning, after the final eurozone inflation figure came in lower than estimated.

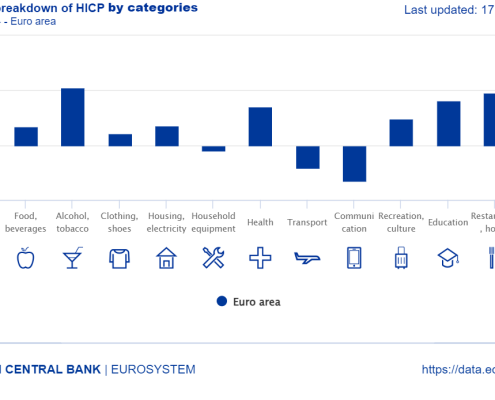

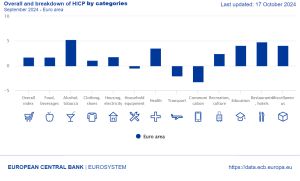

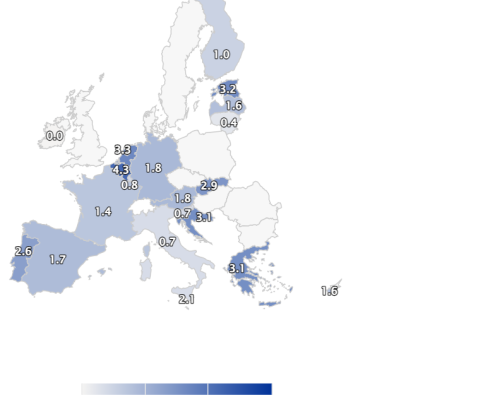

The data showed the headline inflation rate in September at 1.7%, down from 2.2% in August, and slightly below Eurostat’s own flash estimate of 1.8%. Core inflation, which strips out volatile energy and food costs, was slightly down at 2.7% from 2.8% in August. “The incoming information on inflation shows that the disinflationary process is well on track,” the ECB noted in its statement.

A further interest rate cut in December is also considered a done deal among 90% of economists polled by Reuters on Oct. 8, and money markets are pricing in reductions of 25 basis points for December.

In September, only 12% of economists polled by Reuters had predicted an October cut, but most changed their views to predict cuts in both October and December after September inflation data and dovish comments from Governing Council members, including ECB President Christine Lagarde.

All Eyes on December ECB Projections

No new forecasts for inflation or growth were planned for this meeting. In its latest inflation outlook last month, the Bank forecasted headline inflation at an average 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026, as in the June projections. Core inflation forecasts were revised up slightly from June, but ECB staff continued to expect a rapid decline in core figures from 2.9% this year to 2.3% in 2025 and 2.0% in 2026.

As for the economy, the ECB last projected 0.8% growth in 2024, rising to 1.3% in 2025 and 1.5% in 2026. This was a slight downward revision on June’s projections of 0.9%, 1.4% and 1.6%, mainly owing to a weaker contribution from domestic demand over the next few quarters.

New macroeconomic projections will be published in December.

How Far Will Eurozone Interest Rates Fall?

Markets are pricing in reductions of 25 basis points for December, but the future path is more uncertain.

According to Tomasz Wieladek, chief european economist at T. Rowe Price, the ECB will likely cut in the next couple of meetings, but he added that “the tails around ECB monetary policy outcomes are particularly fat at the moment and depend on developments in China and the US.”

Bond markets are already anticipating one rate cut at each ECB meeting until April 2025. “The market expects the deposit facility to ’land’ at 2% during the summer of 2025,” said Kevin Thozet, member of the Carmignac investment committee before the meeting. “Such an expectation seems fair given the current environment. But what happens next, as always, is open to debate.”

Kaspar Hense, Senior Portfolio Manager at RBC BlueBay Asset Management, says the ECB isn’t in a rush, with the real risks being political. A Trump victory could force the ECB to keep the currency weak. But until the inauguration in January, “it most likely be steady as it goes”, with a 25bps reduction every meeting bringing rates to neutral in summer 2025.